Craning to see the horizon: Is the bull run in U.S. real estate over

Real estate remains a popular asset class for institutional investors seeking to diversify their sources of real returns. As the economic cycle reaches its late…

Real estate remains a popular asset class for institutional investors seeking to diversify their sources of real returns. As the economic cycle reaches its late…

Share price dispersion remains prevalent in equity markets, but today’s active managers are having difficulty extracting alpha. They may not be looking in the right…

Risk takes many forms and extends beyond investing. With 25 years in the CIA, David Bridges, now a research analyst at Fidelity Investments, thinks we…

At the first Risk Management Conference, 20 years ago, there were many things plan sponsors probably weren’t thinking about. Currency, for example, says Marlene Puffer,…

Volatility is the traditional measure of risk, but environmental, social, and governance principles can help identify risks that may not reveal themselves in the volatility…

Former Chief Justice of Canada at the 2018 Risk Management Conference

Why bigger isn't always better when it comes to choosing companies

Ignore headlines and build resilience

Seasons Change — And So Do Markets

A U.S. and Canadian perspective on LDI

Dealing with political risk in the time of Trump.

Our interview with Claude Bergeron shows the Caisse breaking down silos.

When it comes to exempt markets, regulators must think differently: Mintz

When it comes to infrastructure, Canadian plans shun the home bias.

Ambachtsheer's proposed retirement income fix.

AIMA survey reveals institutions have ongoing concerns.

How he saw the pension crisis coming back in 1975.

Ira Gluskin: at least Madoff knew what people want. Low volatility.

Assessing the collateral damage from the great QE2 turnaround.

Local pension funds have 60% of assets in Cyprus banks.

How the corporate cash mountain is killing the economy.

The jury is still out on whether they perform.

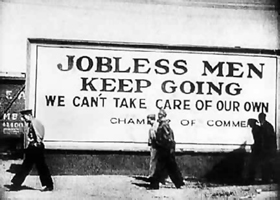

More experts now seeing parallels between 2011 and 1931.

Investors should know many a fund has broken the buck in the past.

New study dismantles a few urban legends about hedge funds.