Canadians received a record $103 billion in benefits from life and health insurers last year, up 60 per cent from a decade earlier, according to the Canadian Life and Health Insurance Association’s annual fact book. The benefits include $53.3 billion in pension annuity payments, $38.1 billion in health benefits for prescription drugs and supplementary health […]

The Halifax Port ILA/HEA has found a way to provide its defined contribution pension plan members with a defined benefit upon retirement — and it’s been doing so successfully for 35 years. As a private sector multi-employer plan, the pension has about 450 active members, 300 retirees and about $210 million in assets. The DB […]

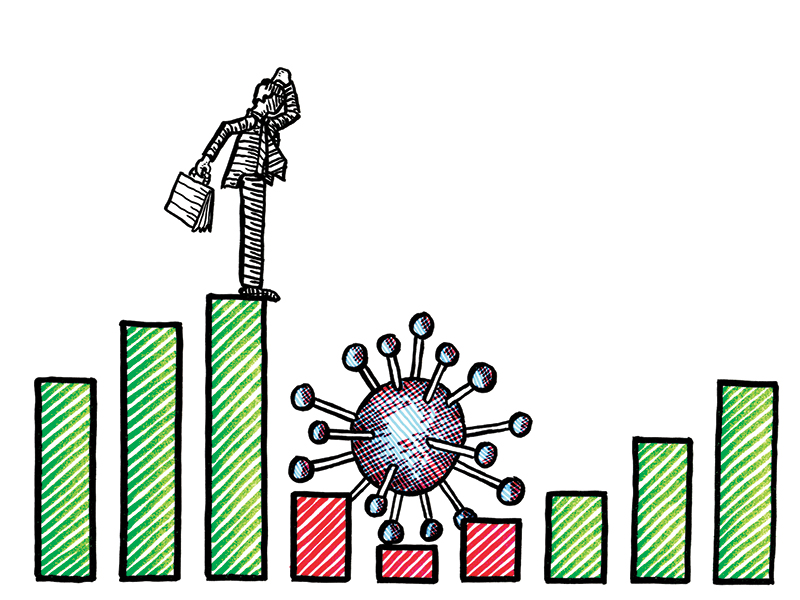

For defined contribution plan members who were intending to retire in the first half of 2020, the market crash caused by the coronavirus may have upended those plans. Markets reached a trough in March, followed by some recovery, but with little clarity on what investments will do next, it’s a challenging time for plan members […]

The Saskatchewan Pension Plan is improving investment choice for members in the accumulation phase and introducing new options to help them through decumulation as well. Leading up to retirement, SPP members are defaulted into a balanced fund, which has been in place since the plan started in 1986. In 2010, it introduced a short-term fund, […]

As you’ll read in this issue’s cover story, our 2020 CAP Member Survey was fielded at the end of March and early April, targeting respondents as they were beginning to face the financial impacts of the coronavirus pandemic. While we still asked our annual questions about capital accumulation plan members’ retirement readiness, we also wanted […]

As if preparing for retirement wasn’t already a steep challenge, along comes the coronavirus pandemic and its impact on the global economy, throwing up even more obstacles for capital accumulation plan members to maneuver. This year’s annual CAP Member Survey, supported by Actuarial Solutions Inc. and Morneau Shepell Ltd., fielded its questions between March 30 […]

The Saskatchewan Pension Plan is improving investment choice for members in the accumulation phase and introducing new options to help them through decumulation as well. Leading up to retirement, SPP members are defaulted into a balanced fund, which has been in place since the plan started in 1986. In 2010, it introduced a short-term fund, […]

A new paper is evaluating how global retirement systems are faring in the wake of the coronavirus pandemic and what reforms will be required to facilitate the retirements of future generations. The paper, ‘Building better retirement systems in the wake of the global pandemic,’ by Olivia Mitchell, a professor and executive director of the pension research council […]

While some defined contribution pension plan members may push their retirement plans back because of market turmoil caused by the coronavirus, others won’t be willing to do so. Those soon-to-be retirees will have to take other measures to ensure they can retire, which will likely include diversifying their potential sources of retirement income, according to […]

In the group benefits world, the first rumblings of the effects of the coronavirus pandemic came when plan sponsors started asking, as early as January, about their travel insurance provisions. “Clients were worried about their business travellers and expatriate employees, in China mostly, and afterwards for their employees travelling for their winter vacations,” said Daniel […]