The federal government is halting solvency special payments for federally regulated defined benefit pension plans until the end of 2020. The moratorium on payments under the Pension Benefits Standards Act is aimed at ensuring that employers have financial resources to continue their operations and pension plans, as well as to protect plan members, said the […]

The Investment Management Corp. of Ontario is taking on the Provincial Judges’ Pension Plan as its latest client. The pension plan is joining with $420 million in assets under management. With the Treasury Board of Canada Secretariat as its plan sponsor, the plan pays out about $44.3 million in annual pension payments to nearly 300 […]

Globally, many pension funds are divesting from carbon and fossil fuels, while others are staying the course and focusing on financial value and their fiduciary duties Simon Archer, partner at Goldblatt Partners LLP and co-director of Osgoode Hall Law School’s Centre for Comparative Research in Law and Political Economy: Political posturing aside, no one seriously […]

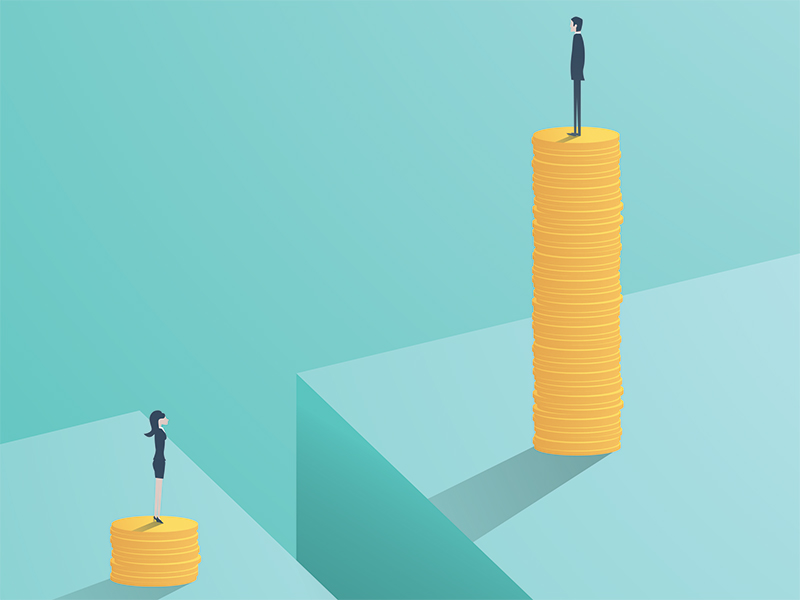

Women are in a worse position than men when it comes to pension savings, thanks to several systemic factors. So how can plan sponsors bridge the gender pension gap and help women prepare for retirement? The gender pension gap continues to be a real and pressing issue. Globally, the World Economic Forum estimates that women’s […]

Changes to Quebec’s pension legislation, including a move away from solvency funding requirements and the introduction of a cost-sharing model, against the backdrop of a low interest rate environment has had a major influence on the City of Montreal’s pension investment strategy. The City manages six plans under one pooled portfolio. The assets from all […]

As the world changes, so do the workforce and workplaces of today, demanding a new approach to how the industry is helping defined contribution plan members save for retirement. During a session at Benefits Canada‘s 2020 DC Plan Summit in Montreal in February, Maria-José Perea, vice-president, business solutions and marketing for group retirement savings at […]

With coronavirus causing market volatility and an increase in the size of solvency liabilities, defined benefit pension plans are feeling the impact. One potential way for plan sponsors to ease the pain is by performing an early actuarial valuation to capture year-end 2019 numbers. While most Canadian jurisdictions require plans to file valuations every three years, […]

The Association of Canadian Pension Management and the Pension Investment Association of Canada have sent the federal government their wish lists for actions to help federally regulated pension plans deal with the fallout of the coronavirus, with a focus on measures to help with cash flow, liquidity and a call for broader solvency reform. As […]

Financial hardship is hitting employers across Canada and they’re starting to make difficult choices around cost-cutting measures within their businesses. “Some plan sponsors may be considering changes to their plan design to address these cost concerns during these turbulent times,” said Jana Steele, partner and department chair of the pension and benefits team at Osler, Hoskin […]

An arbitrator has ruled in favour of the Winnipeg Police Association in its dispute with the City of Winnipeg over the police pension plan. The association filed the grievance in November 2019 after the City attempted to make alterations to the defined benefit pension plan. The changes included increasing employee contributions from eight per cent to 11.5 […]