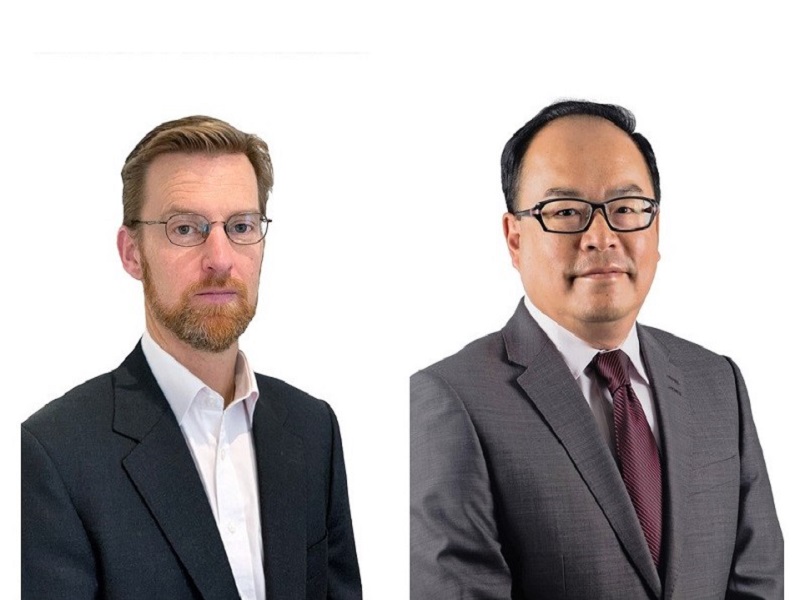

The Ontario Teachers’ Pension Plan is appointing Nick Jansa as senior managing director for its Europe, Middle East and Africa markets. Jansa will be based in the London office and will report to Ziad Hindo, the pension fund’s chief investment officer. As a member of the investment executive team, Hindo will lead the investment activities […]

The Healthcare of Ontario Pension Plan’s struggles when the dot-com bubble burst planted the seeds for the liability-driven investing strategy it’s so well known for today. At the time, the plan had a traditional 60/40 portfolio of equities and bonds, and saw its significant funding surplus quickly turn into a deficit as equities took a […]

Defined benefit plan sponsors are undoubtedly familiar with scenario risk analysis, but applying that concept to their portfolio’s climate risk is a whole new ballgame. Plan sponsors will need to use these risk analyses to get a handle on how exposed they are to climate change risks and opportunities decades into the future, said Alyson […]

Central banks slowing their quantitative easing policies and economic improvements off the back of wide-scale vaccination efforts should both provide bond yields with a modest boost in 2021. But that won’t give defined benefit pension plan sponsors much relief. “You hear the phrase ‘low for long’ and I would agree we’re in an extended period […]

Two experienced pension professionals weigh in on the longstanding debate regarding whether pension plans should be investing actively or passively. Blair Richards, chief investment officer at the Halifax Port ILA/HEA pension plan To see why passive investing should be a part of every portfolio — particularly in today’s environment — first consider its traditional benefits: […]

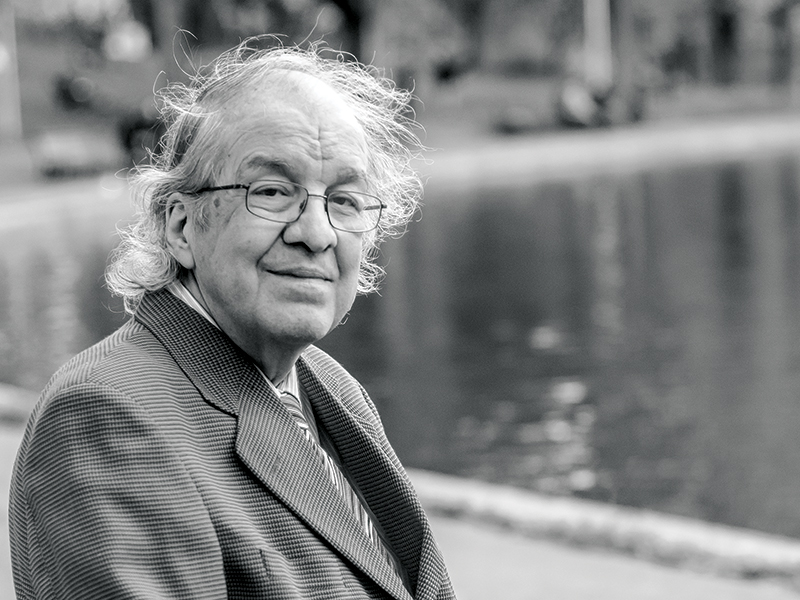

Many employees in the non-profit sector dedicate their lives to helping others. In 2008, a new pension plan was launched to help provide them with a lifetime benefit upon retirement. Michel Lizée, now an independent trustee and pension committee secretary for the Régime de retraite des groupes communautaires et de femmes — or the Community […]

The Federal Court of Appeal has decertified a $100-million class action brought by former members of the Canadian Armed Forces reserves whose retirement benefits were delayed. The court ruled that the original order failed to identify the “common issues” that are required for certification. As well, the court concluded that the representative plaintiff, Douglas Jost, […]

Ontario’s pension plan administrators and plan members share the responsibility of maintaining current contact information, according to the Financial Services Regulatory Authority of Ontario’s final guidance on missing plan members. It recommended administrators maintain a records management system and retention schedules that support long-term administration of the pension plan and to exercise care and diligence […]

What do global institutional investors expect in the coming year? It’s not a rosy picture. According to Natixis Investment Managers’ annual institutional investment outlook, just 12 per cent of institutional investors surveyed said they believe global gross domestic product will bounce back to pre-coronavirus pandemic levels by the end of 2021. Meanwhile, 79 per cent […]

The Public Service Alliance of Canada is reiterating a call for its pension investment manager to divest its ownership in Revera Inc. over the company’s safety record during the coronavirus pandemic, saying the fund should “pull out of the business of long-term care” altogether. The public sector union, which represents 140,000 public sector pension plan members, first said […]