The U.S. Department of Labor is taking jabs at the inclusion of environmental, social and governance products in capital accumulation plans — and it could be to members’ detriment. In late June, the Department of Labor proposed new rules around ESG products in retirement accounts. “The proposal is designed, in part, to make clear that . […]

Janitors working at Loyalist College in Belleville, Ont. have a new ratified contract that includes a pension plan, sick days and a wage increase. The employees, represented by the Services Employees International Union Local 2 and working for the food services company Compass Group Canada Ltd., entered bargaining with major concerns around the lack of sick […]

Over the last several years, a small group of faculty members at the University of British Columbia has been calling on its pension plan’s board of trustees to consider divesting from fossil fuels. As support for divestment grew, the board of the UBC faculty pension plan, which is defined contribution, agreed to assess whether there […]

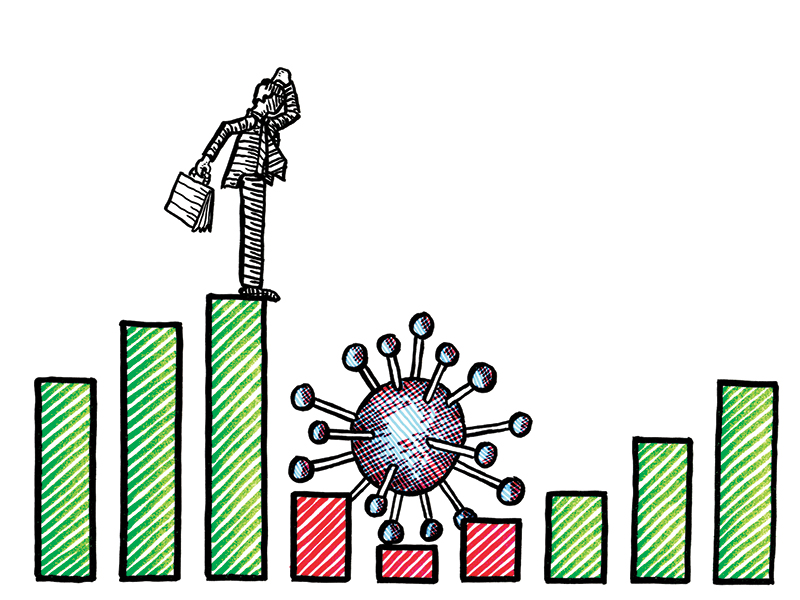

For defined contribution plan members who were intending to retire in the first half of 2020, the market crash caused by the coronavirus may have upended those plans. Markets reached a trough in March, followed by some recovery, but with little clarity on what investments will do next, it’s a challenging time for plan members […]

Much debate remains as to whether private equity is an appropriate option for members of capital accumulation plans. Canada’s neighbours to the south have been examining the potential legal pitfalls of these allocations. A recent information letter from the U.S. department of labor set forth a framework plan sponsors can use to consider the prudence […]

Canadian defined benefit plan sponsors are holding an almost equal amount of fixed income and equity in their portfolios, according to the Pension Investment Association of Canada’s 2019 asset mix report. The report found the PIAC’s membership reported a total of more than $2.2 trillion under management last year, up from just under $2.1 trillion in 2018. As well, […]

The Association of Canadian Pension Management is calling on the Ontario government to consider amending the Employment Standards Act and the Pension Benefits Act to allow for auto-enrolment and auto-escalation features in capital accumulation plans. Specifically, it’s suggesting the government allow employers to automatically deduct employee contributions from payroll to facilitate these features. “The shift […]

While it’s likely a small mercy that defined contribution plan members, by and large, didn’t have knee-jerk reactions to recent market turbulence, plan sponsors have been rather quiet as well. Much of this is related to the reality that the people who typically deal with small to mid-size DC plans at their organization are busy with other […]

The coronavirus pandemic is dramatically affecting workplaces, employers and employees across Canada, according to a new survey by the International Foundation of Employee Benefit Plans. While a third of surveyed employers said they already offered telehealth or telemedicine before the pandemic, an additional 19 per cent said they added it during the crisis and another […]

Firefighters, administrative and infrastructure maintenance personnel at the Saint John Airport are among the newest members to join the Colleges of Applied Arts and Technology pension plan’s DBplus. As part of a new collective agreement that was ratified earlier this year, the employees, who are represented by the Public Service Alliance of Canada, have joined […]