For institutional investors keen to maintain environmental, social and governance commitments made in recent years, there’s a steep climb ahead. The Paris Agreement — and its call to keep climate change to a 2°C warming scenario — is shrinking the investable universe for those still seeking to align with its confines, according to a report from MSCI […]

The Ontario Teachers’ Pension Plan and Ares Management Corp. are both acquiring a majority interest in U.S.-based packaging company TricorBraun. The packaging company’s management team will continue to lead TricorBraun following the close of the transaction and its leadership team will also retain a significant investment in the company, as will its current majority owner, AEA […]

The Canada Pension Plan Investment Board is forming a joint venture with Greystar Real Estate Partners to pursue multi-family real estate development opportunities in target markets in the U.S. The CPPIB has invested US$350 million in equity to the joint venture for a 90 per cent stake and Greystar has allocated US$39 million for the remaining 10 per cent. Greystar will manage […]

The Ontario Teachers’ Pension Plan is among the investors contributing more than US$1.6 billion in Series E+ financing to Zuoyebang, a China-based online education start-up. Other investors in this round include Alibaba Group Holding Ltd., FountainVest Partners (Asia) Ltd., Sequoia Capital China, Softbank Vision Fund and Tiger Management Corp. The funding will be used to […]

The aggregate funded ratio for Canadian pension plans in the S&P/TSX composite index increased from 90.8 per cent to 91.2 per cent during the past 12 months, according to Aon’s pension risk tracker. Aon found the funded status deficit decreased by $200 million, which was driven by asset increases of $18.7 billion and offset by […]

For institutional investors keen to maintain environmental, social and governance commitments made in recent years, there’s a steep climb ahead. The Paris Agreement — and its call to keep climate change to a 2°C warming scenario — is shrinking the investable universe for those still seeking to align with its confines, according to a report […]

A rally on the stock market in the fourth quarter helped boost the strength of Canadian defined benefit pension plans to end 2020, according to a new report by Mercer Canada. The consulting firm said its pension health index, which represents the solvency ratio of a hypothetical DB plan, rose to 114 per cent at […]

The Caisse de dépôt et placement du Québec and local investor Cathay PE are jointly acquiring a 50 per cent interest in the Greater Changhua 1 Offshore Wind Farm, a 605-megawatt facility in Taiwan. The majority of the approximately $3.4-billion deal will be used to pay for the engineering, procurement and construction services for the […]

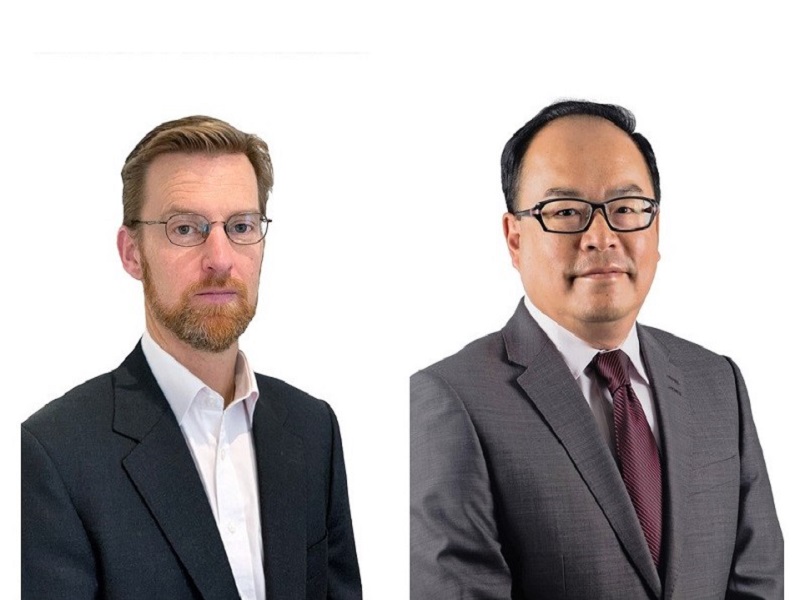

The Ontario Teachers’ Pension Plan is appointing Nick Jansa as senior managing director for its Europe, Middle East and Africa markets. Jansa will be based in the London office and will report to Ziad Hindo, the pension fund’s chief investment officer. As a member of the investment executive team, Hindo will lead the investment activities […]

The Caisse de dépôt et placement du Québec is investing an additional US$1 billion in Invenergy Renewables, a developer and operator of wind and solar projects across North America. The commitment, in the form of new investment facilities, will support Invenergy’s expanded development activities and continued growth, according to a press release. The Caisse began […]