While taking an active approach to investment management is paying off for the Canada Pension Plan Investment Board, the Public Sector Pension Investment Board’s actively managed returns are similar to what they would be if it had taken a passive approach, according to a new report by the parliamentary budget officer. The PBO prepared the […]

Global institutional investors are considering different portfolio constructions to ensure outperformance in what they increasingly worry is a lower return environment, according to a new survey by Fidelity Investments. The survey, which polled 905 institutional investors in 25 countries with combined assets under management of US$29 trillion, found investors with at least $1 billion in AUM expected to make the largest […]

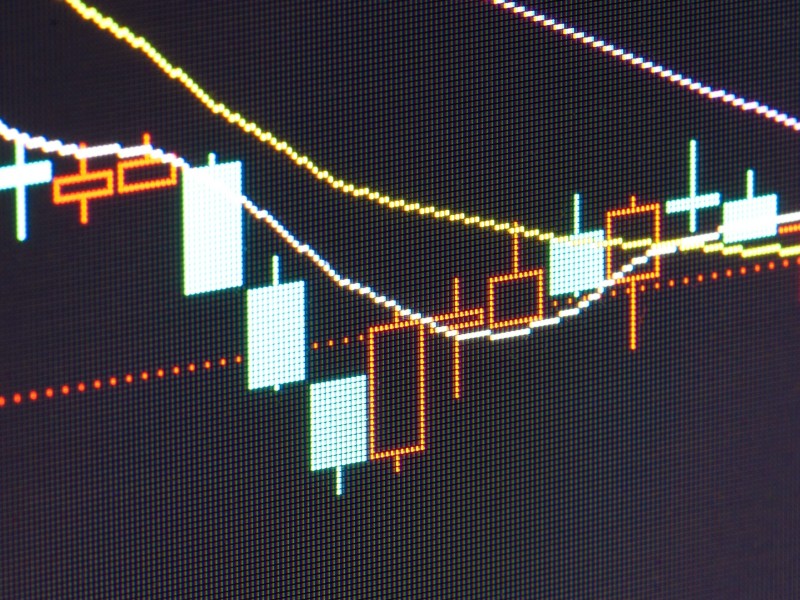

No risk, no reward. Like many things in life, investing inertia and fear are common, but they come with a cost. In the investment world, risk has a specific meaning: the probability of losses relative to the expected return on an investment. The key in this definition are the words ‘expected return.’ When it comes […]

The number of indexes at an investor’s fingertips grew by 12 per cent (or 438,000) in 2018, rising to 3.72 million distinct indexes globally as of June 30, 2018, according to a new report by the Index Industry Association. The association, which began tracking the world’s indexes in 2017, found fixed income was a popular theme during the […]

The role of style factors in fundamental active management

One plan sponsor's take on the active side of smart beta.

Online Debates: A Year in Review Part II

Efficient market hypothesis and modern portfolio theory.

ETFs on the rise as de-risking trend slows.

Should one invest actively or passively?