The Caisse de dépôt et placement du Québec is investing $150 million in CAE Inc., a Quebec-based company specializing in training and operational support for several industries. The investment is part of a $300-million financing drive and will support the company’s expansion plans, according to a press release. This includes the acquisition of Flight Simulation […]

The Canada Pension Plan Investment Board ended its second quarter of fiscal 2021 with net assets of $456.7 billion, up from $434.4 billion, according to a new report. The $22.3 billion increase in net assets for the quarter consisted of $21.6 billion in net income after all costs and $700 million in net CPP contributions. The […]

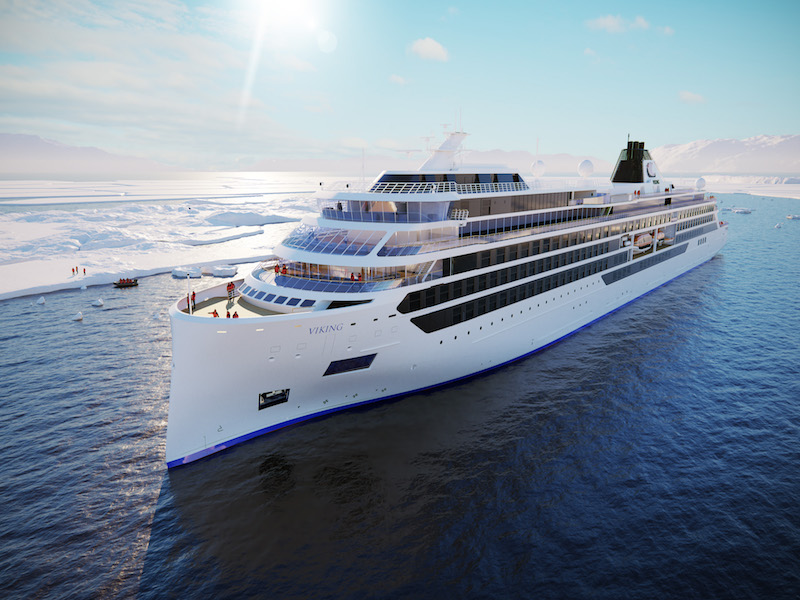

The Canada Pension Plan Investment Board and TPG Capital are increasing their investment in Viking Holdings Ltd. The CPPIB and the private equity platform were already minority stakeholders in the parent company of Viking Cruises. The additional investment means about US$500 million of net proceeds will be available to support Viking Cruises continued development. Read: CPPIB invests in cruise […]

The Caisse de dépôt et placement du Québec is entering a US$300 million warehouse financing agreement with Titan Aircraft Investments Ltd. The warehouse facility will provide debt capital to finance Titan’s acquisition of freighter aircraft leases. The Caisse and BNP Paribas are joint lead arrangers and lenders in the transaction. “This investment is well-aligned with […]

The Canada Pension Plan Investment Board is allocating an additional £300 million of equity to investments in the U.K.’s logistics sector. The investment is taking place via the Goodman U.K. partnership, which was established in 2015, with Goodman Group and APG Asset Management each allocating the same amount. The CPPIB has entered similar partnerships with […]

Canadian defined benefit pension plans posted a median 3.13 per cent return for the third quarter of 2020, following a strong market rebound, according to a new report by BNY Mellon Asset Management Canada Ltd. The organization’s master trust universe, which is comprised of 86 Canadian corporate, public and university pension plans, found U.S. equities was the […]

The Caisse de dépôt et placement du Québec is part of a $53-million round of Series C funding for AddEnergie Technologies Inc., a Quebec-based operator of electric vehicle charging stations. The Caisse initially invested in the company in 2016 and again in 2019, alongside partners. This round of funding included MacKinnon, Bennett & Co. Inc., […]

The Investment Management Corp. of Ontario has closed three private equity fund commitments totalling $1 billion. The three funds are: Kohlberg Investors IX, which aims to make control investments in North American middle-market companies in the business services, consumer, industrial manufacturing, health care and financial services sectors: Nordic Capital X, which aims to make control investments […]

The private equity market was on a hot streak coming into 2020 and despite the economic wreckage caused by the coronavirus, fundraising has generally held up, said Jamie Becker, counsel for private equity and pension fund investments at Torys LLP, when speaking at the Canadian Investment Review’s 2020 Global Investment Conference in September. “There was […]

As institutional investors increase allocations to alternative investments, it becomes increasingly challenging to understand risk. A new paper, co-authored by Spencer Couts, assistant professor of real estate at the University of Southern California; Andrei S. Goncalves, an assistant professor of finance at the University of North Carolina; and Andrea Rossi, an assistant professor of finance […]