Newfoundland and Labrador residents can now unlock benefits held in locked-in retirement savings arrangements for reasons of financial hardship or non-residency in Canada. The changes are in effect as of March 1 and only affect locked-in retirement savings arrangements such as locked-in retirement accounts, life income funds and locked-in retirement income funds, according to a press […]

The Canadian Life and Health Insurance Association is calling on the federal government to provide Canadians with access to more-secure retirement income. In its submission to the 2021 federal budget, the CLHIA recommended that Canadians in and approaching retirement have access to flexible annuity options within registered pensions, registered retirement savings plans, registered retirement income […]

Despite market uncertainty due to the coronavirus pandemic and a turbulent U.S. presidential election cycle, Canadian defined benefit pension plans ended the year with near double-digit gains, according to a report by the RBC’s Investor & Treasury Services. Amid the once-in-a-century crisis, market returns in 2020 for retirement assets were 9.2 per cent, noted the […]

Since the World Health Organization declared a global pandemic almost 11 months ago, the resulting economic uncertainty as the coronavirus crisis drags on has resulted in some employees finding it increasingly difficult to save for the future, according to a recent survey. The survey by Ipsos for Toronto Dominion Bank revealed one quarter (25 per […]

While the rollout of vaccines has the world cautiously optimistic about an economic recovery, a Scotiabank survey shows the coronavirus pandemic has Canadians concerned about their retirement future. According to the survey, 72 per cent of Canadians said they’re worried they’re not saving enough for retirement, while one-third (32 per cent) said they won’t be […]

While the rollout of vaccines has the world cautiously optimistic about an economic recovery, a Scotiabank survey shows the coronavirus pandemic has Canadians concerned about their retirement future. According to the survey, 72 per cent of Canadians said they’re worried they’re not saving enough for retirement, while one-third (32 per cent) said they won’t be able to […]

The Canada Life Assurance Co. is absorbing the Toronto-Dominion Bank’s TD Future Builders retirement savings plan program members as of March 19. “We believe Canada Life will deliver a strong group retirement and savings experience that supports the needs of TD Future Builder business customers and their employees, while allowing [Toronto-Dominion Asset Management Inc.] to […]

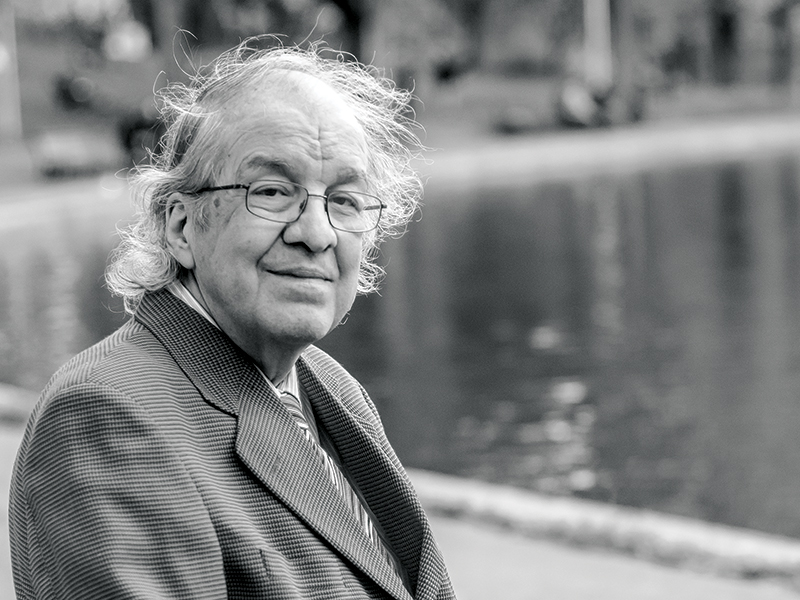

Many employees in the non-profit sector dedicate their lives to helping others. In 2008, a new pension plan was launched to help provide them with a lifetime benefit upon retirement. Michel Lizée, now an independent trustee and pension committee secretary for the Régime de retraite des groupes communautaires et de femmes — or the Community […]

The average Canadian taking Canada/Quebec Pension Plan benefits at age 60 instead of waiting until 70 can expect to lose more than $100,000 of secure lifetime income, according to a new research paper by Ryerson University’s National Institute on Ageing and the FP Canada Research Foundation. The paper found a $1,000-monthly benefit in today’s dollars at […]

In Monday’s fall economic statement, the federal government proposed changes to employee stock option rules and offered additional support for essential workers. The statement provided an overview of the government’s approach to combating the ongoing coronavirus pandemic, while offering details on additional measures moving forward. The changes to employee stock option tax rules include an annual […]